Despite rising diplomatic tensions between India and Canada, Canadian pension funds have so far remained committed to investing in India.

According to the National Investment Promotion & Facilitation Agency (Invest India), Canada ranks as the 18th-largest foreign investor in India, with cumulative investments totalling $3.31 billion from 2020-21 to 2022-23. Canadian investments account for 0.5 per cent of India’s total foreign direct investment (FDI), with services and infrastructure comprising 41 per cent of these inflows.

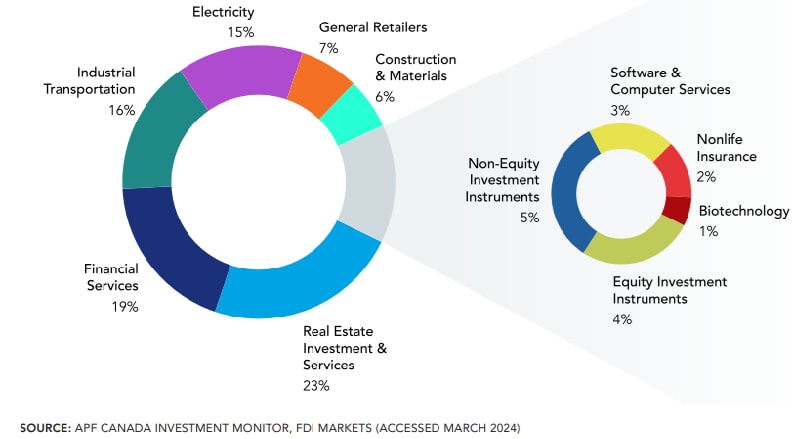

Canadian Pension Fund Investment Flows into the Asia Pacific by Top Destination Country, 2013-2023

Shifts in Investment Focus

Historically, Australia has been the largest recipient of Canadian pension fund investments, receiving 50% of the total. China, once a close second, saw its share drop from 19% to just 3% in the last five years, prompting Canadian funds to diversify their portfolios. In contrast, India’s share of Canadian pension fund investments has risen from 10% (2003-2018) to 25% (2019-2023), revealed the report titled ‘ Canadian Pension Fund Investments in the Asia Pacific.’

Notable Investments

Examples of significant investments include the Ontario Municipal Employees Retirement System’s CAD 186 million stake in IndInfravit Trust’s toll road portfolio and the Canada Pension Plan Investment Board’s CAD 283 million investment in the National Highways Infra Trust. Additional investments by Ontario Teachers’ Pension Plan Board, totaling around CAD 683 million, include stakes in key infrastructure projects.

Resilience Amid Political Strains

Despite deteriorating bilateral relations following Prime Minister Justin Trudeau’s allegations linking India to the assassination of a Canadian citizen, Canadian pension fund investments in India increased from CAD 28 million in Q3 2023 to CAD 111 million in Q4 2023. This growth was primarily driven by a major investment in Xpressbees by the Ontario Teachers’ Pension Plan Board, as per the Asia Pacific Foundation of Canada, an independent, not-for-profit organization focused on Canada’s relations with Asia

Impacts of Diplomatic Issues

The cooling relationship has stalled negotiations for a Canada-India early progress free trade agreement, which was paused in September 2023. Additionally, business travel between the two countries was affected when India suspended visa services for Canadians, creating hurdles for companies looking to expand their networks. Although these visa restrictions were lifted after a month, the incident highlighted how political tensions can influence investor confidence in the Indian market.

Optimism for Future Trade

“With Canada-India political tensions showing no signs of improving in the immediate future, Canadian investors will have to continue monitoring both the opportunities and risks of investing in an economy that is expected to become the world’s third largest by 2027. We still anticipate that Canadian pension funds will expand their presence, not only in India

but also elsewhere in the Asia Pacific, in the future. If they do, this expanded presence will align with the aims of Canada’s Indo-Pacific Strategy and its calls to increase investment and trade with the region,” noted the report by Asia Pacific Foundation of Canada.

Political context

The recent diplomatic row between India and Canada stems from allegations of Indian government involvement in the assassination of a Canadian citizen in Canada.

In September 2023, Canadian Prime Minister Justin Trudeau announced that there were “credible allegations of a potential link between agents of the government of India” and the assassination of a Canadian citizen on Canadian soil. This led to a significant deterioration in bilateral relations.

In May 2024, the RCMP arrested four Indian nationals on first-degree murder and conspiracy charges related to the assassination. These arrests further escalated tensions between the two countries.

Here is a breakdown:

Serious accusations: Trudeau’s claims suggested that India may have been involved in the extrajudicial killing of Nijjar on Canadian soil. This was a major allegation, as it implied state-sponsored action against a foreign citizen in Canada.

India’s Response: India strongly denied the allegations, labeling them as “absurd” and asserting that Canada was sheltering individuals who promote separatism and terrorism. In the wake of Trudeau’s remarks, India accused Canada of failing to address these security concerns.

Diplomatic Actions: Following the allegations, both countries expelled diplomats from each other’s embassies. Canada called for a thorough investigation, while India emphasized its right to safeguard national security.

The diplomatic row has had several consequences:

Suspension of Visa Services: The Indian government suspended visa services for Canadians, impacting business travel and people-to-people exchanges.

Stalled Trade Negotiations: The Canada-India early progress free trade agreement (EPTA) negotiations have been paused due to the strained bilateral relations.

First Published: Oct 15 2024 | 3:54 PM IST

Leave a Reply